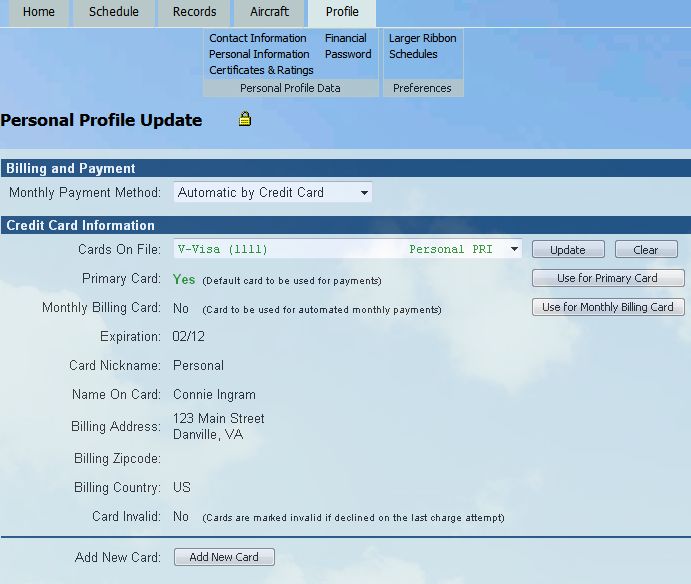

Primary Credit Card

Adding/Selecting a Credit Card

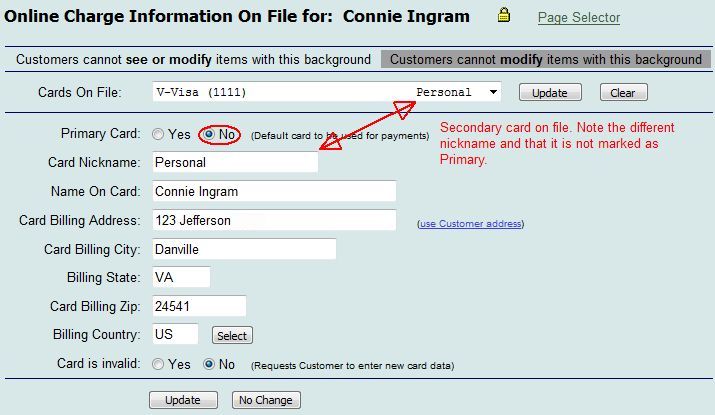

Additional / Secondary Credit Cards

| Online Credit Card Guide | Back Forward Print this topic |

Advanced Edition subscribers have the option to sign up with AHT Gateway for a merchant account and online credit card processing gateway. For more information, please see Online Credit Card Processing.

If your organization uses this option, when a credit card is presented as payment, the credit card information is entered into your MyFBO system and sent through the connected AHT Gateway. AHT Gateway software stores the card information and sends the information off to the issuing financial institution. The issuing financial institution will send back an approved or declined message for the transaction.

The full credit card number is never stored or viewable in your MyFBO system for Visa, MasterCard, American Express, Discover, or JCB cards. The card numbers are stored in the AHT Gateway PCI Compliant vault, and a token representing the card number is returned to your MyFBO system. Subsequent charges or refunds are handled through the passing of the token.

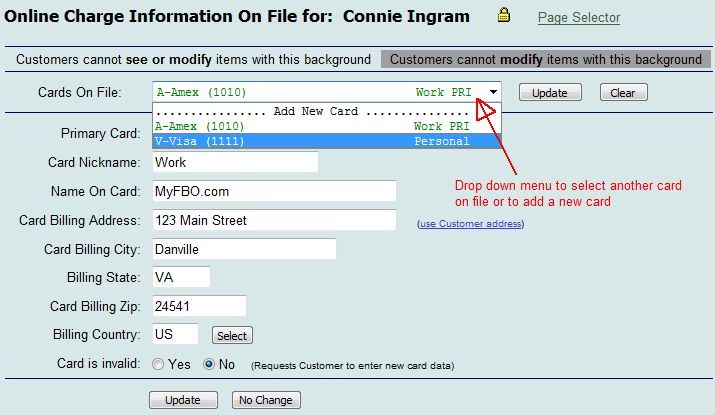

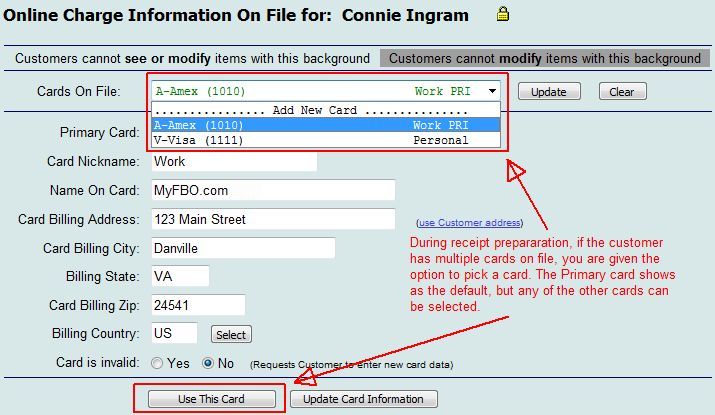

Multiple credit card tokens can be stored for a customer, making it possible for customers to designate individual cards for different uses, such as a separate card for each aircraft, a specific card for their monthly bill, or separate cards for business or personal transactions.

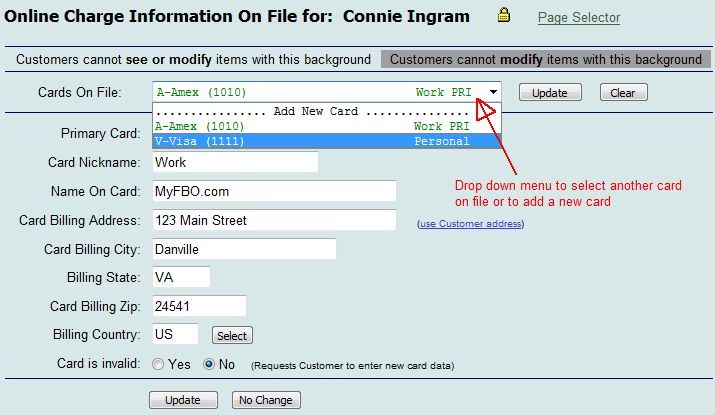

Online Charge Information in Customer Records

To review or update online charge information for a customer:

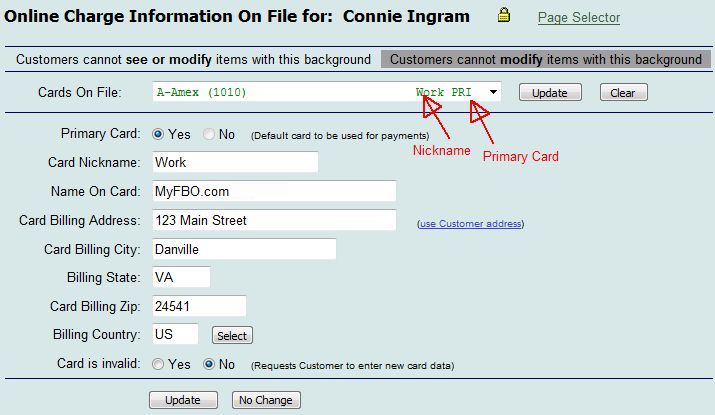

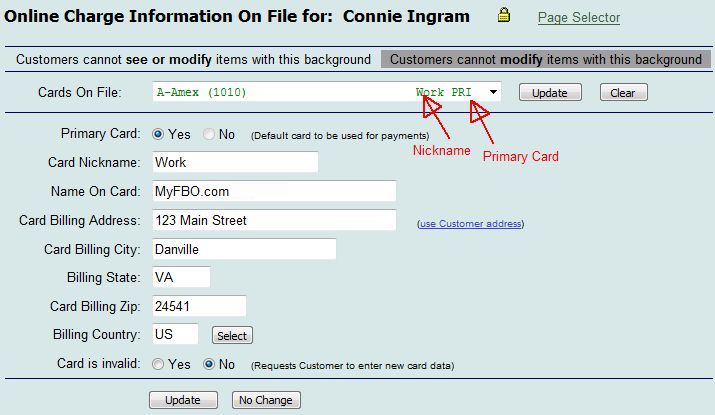

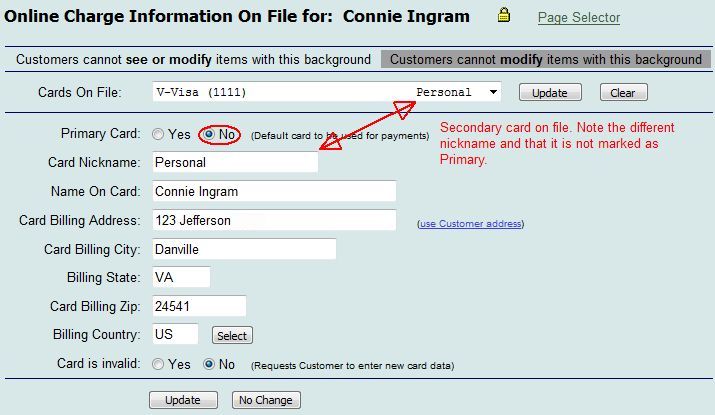

Each credit card token can be given a nickname to distinguish it's purpose and help the customer recognize the card.

The default credit card token used for transactions is called the Primary. It is the first stored, but if multiple tokens are on file for a customer, customer or staff can change which is the Primary.

Please see the screen shots below for more information.

Primary Credit Card

Adding/Selecting a Credit Card

Additional / Secondary Credit Cards

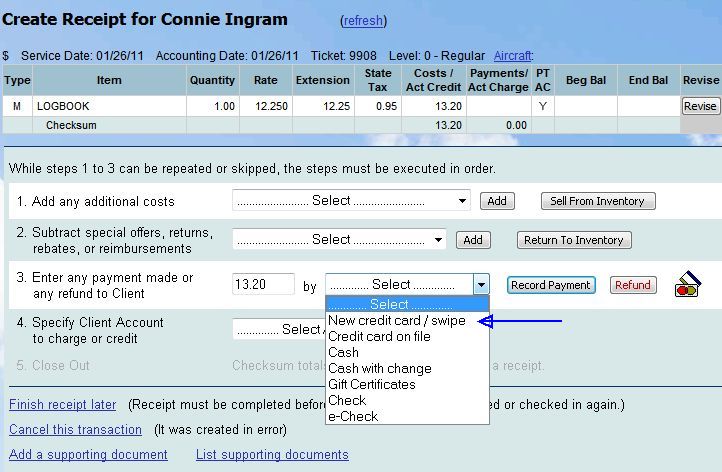

Credit Cards During Receipt Preparation

The easiest and quickest way to enter and store credit card information for a customer is during receipt preparation.

During receipt preparation selecting New Card as the payment type includes the options to Keep Data On File (save the token for future use) and to assign a Card Nickname.

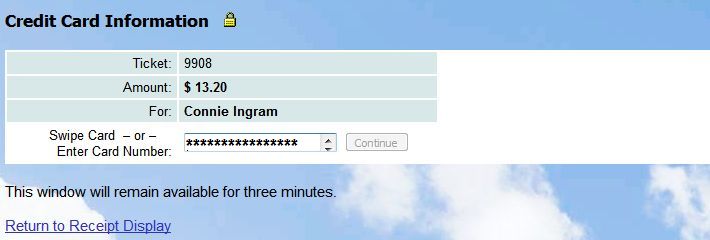

It is essential that credit card charges be run correctly on the first attempt. The ticket should always be reviewed for correctness BEFORE charging the credit card.

Here's an example using a New Card:

New Credit Card / Swipe

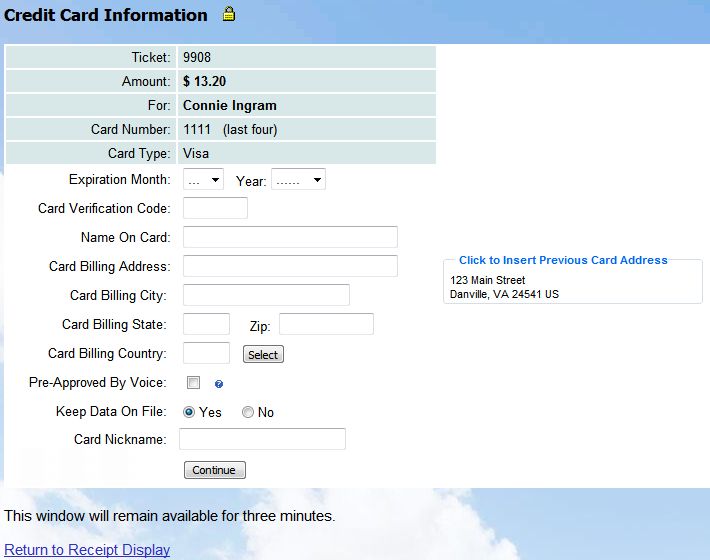

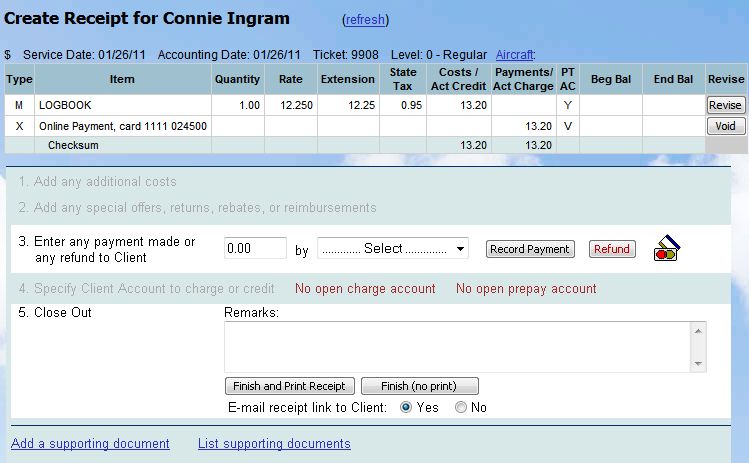

Credit Card Entry

Credit Card Information

Credit Card Information Completed

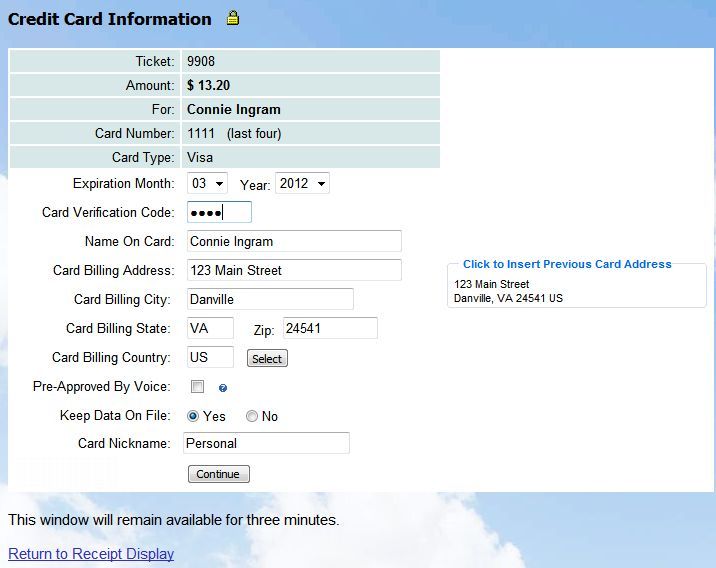

Credit Card Declined

Credit Card Approved

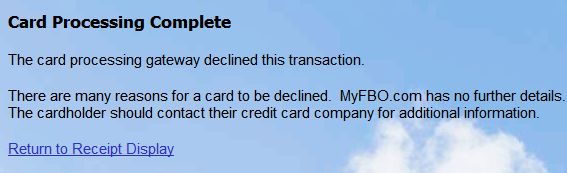

Credit Card Transaction Complete

It is important to remember that a decline is not a bad reflection on

your customer. MyFBO support staff often get calls from flustered

subscribers telling us that the card declined, but the individual is a good

customer and surely the card is "good". Cards get declined for all

kinds of reasons, some of which have nothing to do with the customer's

account standing. The best way to get to the bottom of the issue is for the

customer to call the contact number on their card right then to find out the

problem.

A decline message does not mean there is an error in processing. If there is an error in

processing, you will receive an error message or an error code. If you

receive an error, follow any directions given on screen. If you are unsure

of what action to take, contact MyFBO Support promptly for assistance.

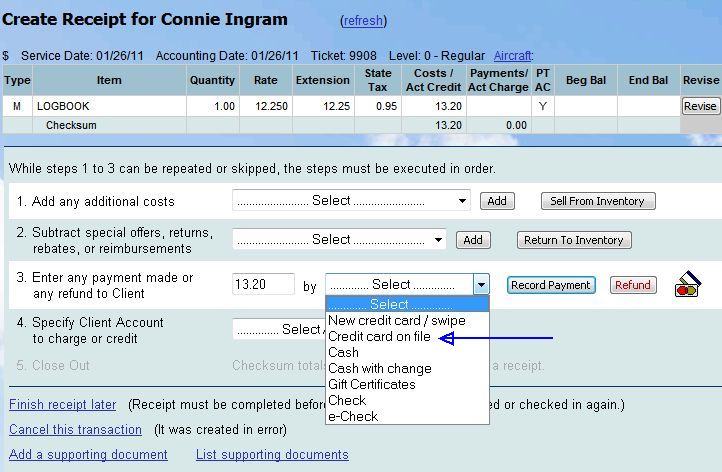

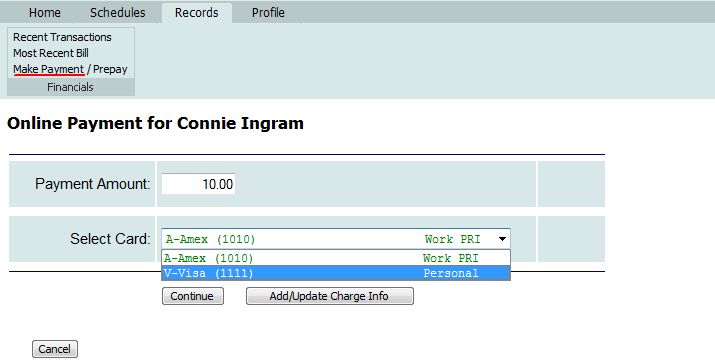

If a customer already has credit card tokens on file, during receipt preparation selecting Card on File as the payment type will prompt the user to select which card to charge. After a card is selected, the process is the same as previously outlined.

Credit Card On File

Selecting from multiple cards

Card Verification Codes (CVC)

In some small part, the rates your organization pays for processing credit cards are based on the "security" of the transaction. The inclusion of the Card Verification Code (CVC) in the transaction increases the security of the transaction. It's also important if a customer ever disputes a charge.

Swiping credit cards is the best choice, followed by keyboard entry or using card on file. If you key enter or use the card on file, you should always input the Card Verification Number (if available) in the appropriate field. The Card Verification Number is NOT stored for subsequent transactions as this is against credit card industry regulations.

Batching and Voids

When you take a credit card as payment on a transaction, either by key entering the card data, swiping the card, or using the card information stored on file, the transaction processes for approval at that time.

The customer's credit card account is actually charged when credit card transactions are next batched (typically overnight).

Batching is an end-of-day process that compiles all of your credit card transactions for the day and sends them to the credit card processor. Your organization may choose to manually batch as a part of your daily closing process (Financial Tab / Cash Management menu). If you do not manually batch, automatic batching will batch for you. This is the most commonly used method. (Automatic batching occurs at �11:30 p.m. Central Time only if there is no manual batch earlier than 5:30 p.m. Central Time.)

Leaving a receipt open / unfinished does not stop an approved credit card transaction on the receipt from processing. If the charge is on the receipt and approved, the charge processes when the credit card transactions are next batched. The customer's credit card is charged whether the receipt is open or finished.

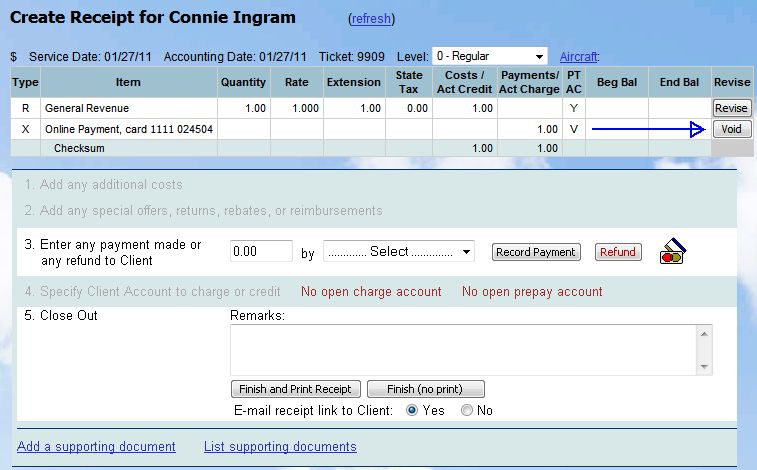

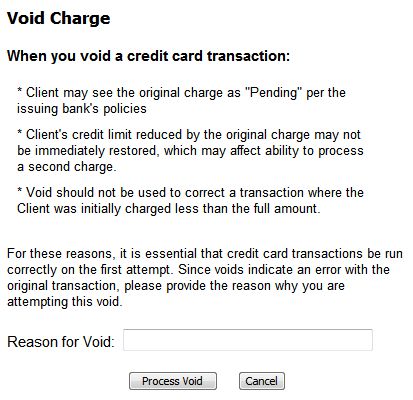

A credit transaction can be voided the SAME DAY it's made if it has not been batched. You'll know if a void is possible if the Void button is available on the payment line of the receipt. Please see the screen shot below. After batching or date change, the only resolution is to close the receipt with the charge on it and open a new transaction to create a refund. For details on creating a refund receipt, please see Guide to Receipt Preparation.

Void Option

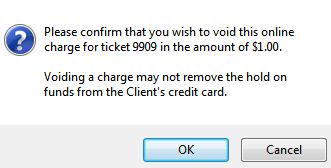

The void option exists to retract a charge, but should not be used if there is any other option available. When void is used to correct a ticket, it is not a magic eraser. When a ticket is prepared for a customer and processed against their credit card, a hold gets placed against their card for those funds. Clicking Void doesn't make that hold go away. The hold lowers their available credit, and depending on the card type, the hold can remain in place for days or longer. This may also affect your ability to re-process the charge. This can be even more serious for an individual using a debit card, since it is a hold against actual bank funds. For this reason, when you attempt a void, you are required to go through a confirmation step and record the reason for the void. The reason is stored in your MyFBO system and appears on the ticket summary in case you need to explain your action to your customer.

Void Confirmation

Reason for Void

Pre-Approved by Voice

On rare occasions, MyFBO subscribers who process credit cards online through MyFBO and AHT Gateway may need to obtain approval for a credit card transaction by phone from the card issuer (Visa/MasterCard, American Express, Discover, etc.). This phone approval could occur in the following circumstances:

Be prepared for this in advance by printing your list of contact phone numbers and merchant IDs available in your MyFBO system from the Reference Tab / Voice Authorization menu. You should also read and print Credit Card Voice Authorization, and Credit Card Voice (Phone) Authorization Form.

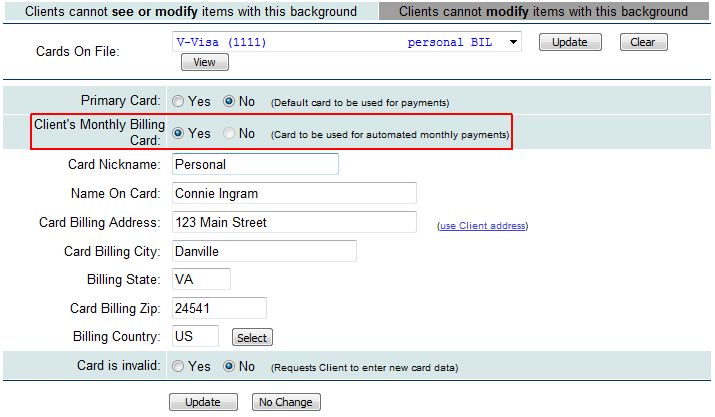

Monthly Billing

If you use MyFBO Online Monthly Billing and automatically collect the monthly payments, an additional option exists in the customer record to designate a card to be used for automated monthly payment. If no card is designated, the Primary is used.

If customers/members have been allowed access to update their credit card information online, they also have the option to designate the card to be used for monthly billing.

Monthly Billing Card

Options Available to Customers/Members

Depending upon Customer Menu Parameters settings in your MyFBO system, and whether or not you provide customer login access, customers/members may have the ability to add and update credit card information, and to select which card token to use for different payment functions.

Customer/Member Credit Card update screen

Customer/Member Payment to Account screen

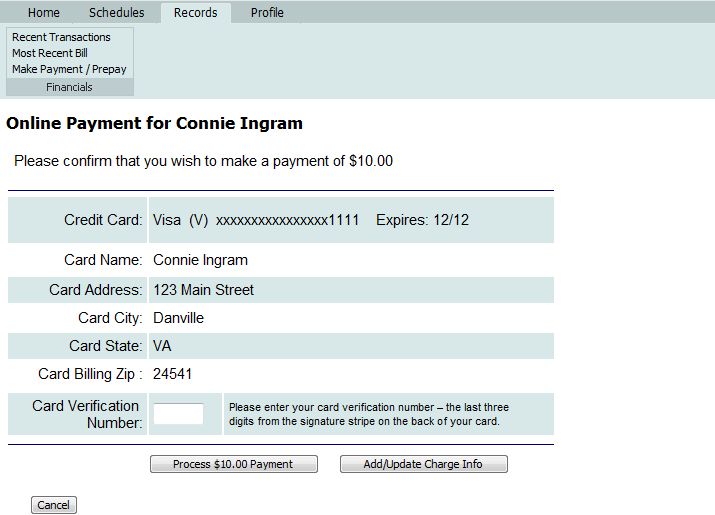

Customer/Member Payment Confirmation screen

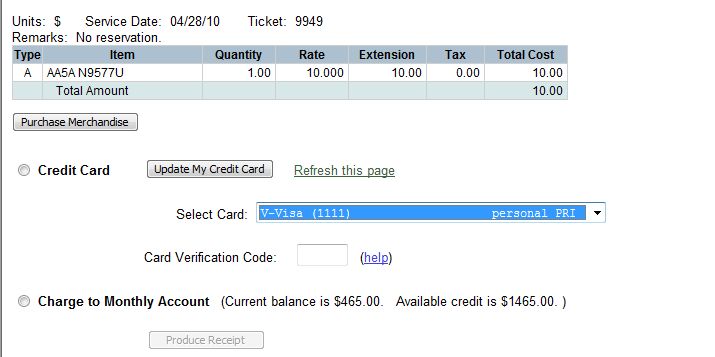

Customer/Member Payment screen

Maximum Number of Cards Per Customer/Member

To prevent errors caused by selecting the wrong card, it is recommended that you select an appropriate warning level to limit the maximum number of cards that may be stored for each customer/member. The maximum number of cards per customer/member is set by an Administrator in the Financial Parameters / Credit Card settings section in your MyFBO system.

Financial Parameters Max. Cards per Customer/Member parameter

Warning when Customer/Member exceeds limit

| Copyright © MyFBO.com [email protected] |

01/27/11 cli